Ever since I attended a presentation on the federal debt in 1983 the topic has stayed in my mind. We have this beautiful country, created by the genius of James Madison, and we are slowly killing it.

Let's Talk About Debt

People always complain about taxes, but in theory they are not so bad. The idea is that a government collects money to pay employees and buy goods and services. So, the money sucked in goes right back out into the economy. I'm happy to say that 49 U.S. states have a requirement for a balanced budget. Vermont is the only exception.

On the federal level, this is not the case. Each year the U.S. Congress approves a budget that spends more than it collects, and each year the national debt grows larger. So, instead of the money going straight back into the economy, a bigger hunk of our annual budget is spent paying interest on bonds. Even worse is when China and other countries buy our debt — in this case your hard-earned tax money goes straight out of the country.

Why citizens and Congressional members are not screaming about this amazes me. Why our presidents don't make this a major issue shocks me. Our current and past presidents are the captains of the Titanic and our Congress is the crew. Few people seem to care that they are piloting a sinking ship. "Eat, drink, and be merry, for tomorrow we shall die," is the mantra of our government.

The Conundrum

Our president rambles about rebuilding infrastructure and expanding the military while Democratic Socialists call for free college and "Medicare for all." The truth is, we can't afford to do any of that, unless we go into debt more. And sorry, there's no money for a wall.

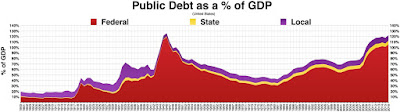

Right now the federal debt is 78% of Gross Domestic Product (GDP) and is projected to be 93% in a decade. By then, the United States will be so saddled with debt that the only thing we can do is sink farther into the abyss.

I'm surprised to find how little information there is on the federal debt — it's like the alcoholic relative that no one wants to talk about. The best source I've found for putting the crises into plain English is Investopedia. According to this source our national debt as of January 2019 was $21.9 trillion. Already, the national debt has grown 10% under Father Trump, and it doubled under the 8-year reign of President Obama (from $10 trillion to $20 trillion). Wars are expensive and while Obama's "stimulus package" supposedly saved the economy, it only created more debt and bought us only a little more time. It's likely that the economy will crash again soon, and when Trump does a "bailout package" he'll be hailed as a great hero. Every conservative will have a bobblehead likeness of Trump above their fireplace and he will be worshipped as the great savior. But, guess what? Bailouts only delay the inevitable.

I'm surprised to find how little information there is on the federal debt — it's like the alcoholic relative that no one wants to talk about. The best source I've found for putting the crises into plain English is Investopedia. According to this source our national debt as of January 2019 was $21.9 trillion. Already, the national debt has grown 10% under Father Trump, and it doubled under the 8-year reign of President Obama (from $10 trillion to $20 trillion). Wars are expensive and while Obama's "stimulus package" supposedly saved the economy, it only created more debt and bought us only a little more time. It's likely that the economy will crash again soon, and when Trump does a "bailout package" he'll be hailed as a great hero. Every conservative will have a bobblehead likeness of Trump above their fireplace and he will be worshipped as the great savior. But, guess what? Bailouts only delay the inevitable.

I know there are far more important things to worry about than the national debt, such as what is Justin Bieber wearing? What's going on with the Kardashians? And can you still live after missing an episode of "Game of Thrones?" But, really, our Congress and last few presidents have been kicking the can down the road and basically ignoring the problem.

Every few years some fiery fiscal conservative in Congress will stand up and scream for a balanced budget amendment, but there's never enough votes. The last balanced budget amendment to receive a vote in the House was proposed by Rep. Bob Goodlatte of Virginia in April 2018, and promptly failed. Instead, what we got from other Republicans was a bill that cut taxes, and we were told the great lie that lower taxes would spur the economy and create more tax revenue. This is similar to the lie that Ronald Reagan and his minions told us about "trickle down" economics. In reality, the Reagan tax cuts and military buildup caused the deficit to spike, and few dollars ever reached us bottom feeders.

Debt is something our nation has struggled with since the Revolutionary War. Since then, more wars, recessions, and inflation have all contributed to growing the debt. Applause goes to the Clinton administration, which actually had an annual surplus for a few years in the late 1990s. Applause also goes to Andrew Jackson, who was the only president ever to pay off the debt in 1835.

As of right now, every individual in the United States owes $40,000 in debt, which sounds creepier than just saying "70% of GDP."

Where Does the Money Go?

Our government is spending $1.1 trillion on healthcare, mostly Medicare and Medicaid. Another $1 trillion goes to Social Security, and then $1.1 trillion goes to defense. The rest of our country's line items, such as transportation and veterans benefits, are pocket change in comparison to the three main items mentioned above.

I am currently 58 years old and part of me is hopeful that I can get out of this world before everything crashes. I look forward to enjoying my Social Security/Medicare safety net, but the whole system is tottering under extreme financial stress and I'm not sure if it will be around when I become an official old fart. They may just put me on an iceberg and shove me away or I may have to stand before one of Obama's Death Panels. The U.S. government has to come up with $3.2 trillion in the next decade to fund Social Security and Medicare Part A, and there's no way to do it.

What This Means To Me & Alfie

The increased national debt is putting a slow drag on the entire economy by affecting interest rates, investments, and general economic performance. This anemia is coming at a time when American productivity is declining, due in part to our aging population. There is no way out of this trap, except through uncomfortable sacrifice. Eventually, America will be so burdened by debt that infrastructure projects, job growth programs, and any other initiative will become unaffordable.

Oh, and sorry folks, we can't just print more money. This tactic causes inflation and diminishes everyone's savings.

What You Can Do

We must demand that our elected officials behave in a fiscally responsible way. This means no tax cuts in exchange for votes and no giant social programs that have no payment mechanism. Our federal government needs serious fiscal reforms. The longer we put off dealing with the giant elephant in the room the more painful it will be to fix the problem in the future.

Only seven other nations have a debt crises worse than ours — Japan, Greece, Portugal, Italy, Bhutan, Cyprus, and Belgium. The debt crises of these nations regularly makes the news. At least Greece had the European Union to bail them out. It's shameful that a country as great and large as ours should be in such a pathetic debt situation. It's disgraceful.

So, at the next Trump rally, while you are waving your red hat as Father Trump takes the stage, think about the real issues that affect us. And as for you Democrats, your leaders are no better when it comes to debt. The American federal debt crisis is a nonpartisan issue, and EVERYONE shares some responsibility. Every time a politician suggests a tax cut or new program, scream, "How are we gonna pay for it?"

Sadly, I found very few organizations that advocate for a balanced budget. If people were as passionate about the federal debt as they are about their guns, we might have a chance. We need a public advocacy movement to push for fiscal responsibility. If we allow the government to borrow more money to give us more free stuff, we are selfishly benefiting ourselves at the expense of our children, grandchildren, and country as a whole.

If you want to help pay off the debt, there is a GoFundMe page that is trying to raise $1 billion (which will help reduce the $21 trillion). Send them 5 bucks and then you can go back to your normal life routine and live in peace. If you would like more information or if you want to get involved in the balanced budget cause, click on the links below.

Resources & Sources:

- Peter G. Peterson Foundation - Raises public awareness of urgent fiscal issues facing the U.S.

- The Concord Coalition - Advocates for smarter fiscal policy.

Additional Sources:

No comments:

Post a Comment

I apologize for requiring verification of comments. I had to do this because of all the spam.